Financing Models for a Sustainable World

This course will provide insights into sustainable finance aspects.

This course will provide insights into sustainable finance aspects.

Our economic models were developed in the age of resource abundance when natural resources were plentiful and carbon emissions limited. No environmental concerns were factored into these models, only labour and capital. Likewise, financial theory does not account value to natural resources beyond their near-term cash flows[1].

The financial system is integral and crucial to achieving a smooth transition to a low-carbon economy!

This course will provide insights into sustainable finance aspects like governance and financial behaviour, changing financial strategies, integrated reporting, investing for long-term value creation, equity investing, impact investing, green bonds, new forms of lending, microfinance, sustainable project financing, social entrepreneurship and transition management.

Building on the basics of finance, the topics addressed will give students tools to invest and fund businesses in a more sustainable way. Application of the theory in a practical way is of course part of the course, and supported by the book on Principles of Sustainable Finance several articles and cases. [2]

Topics that are covered by the course are:

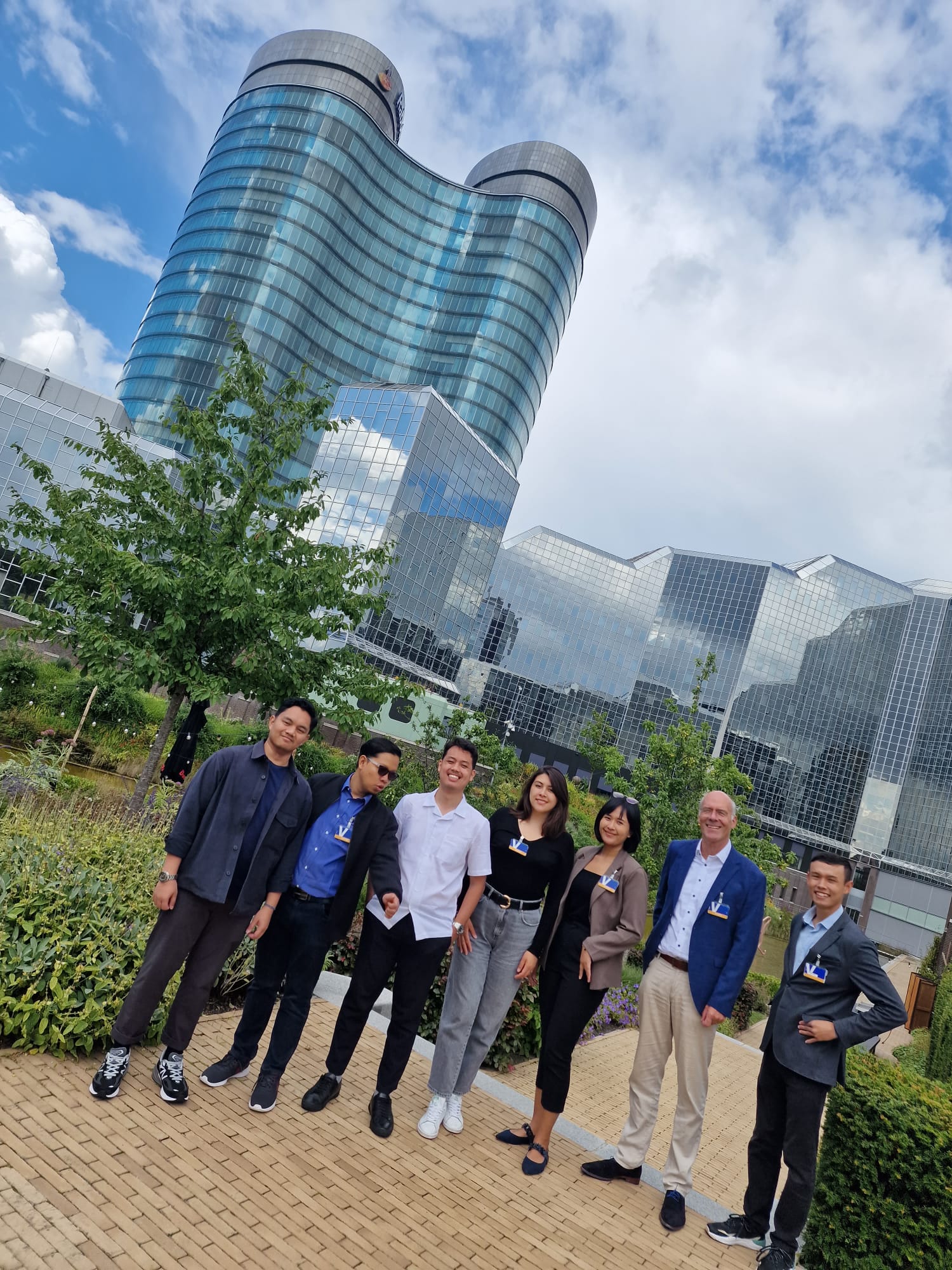

The lecturers have extensive experience in the international financial world and in teaching finance and banking courses in an international setting.

Also, guest lectures will be part of the course, with presentations by e.g. Ecovadis and a bank. In one of the project assignments, students will develop a financial plan. Students will also work on a (financial) assignment provided by a real-life (social) company.

[1] Schoenmaker, D. and W.Schramade (2019), “Principles of Sustainable Finance”, Oxford University Press

2] eg Verdoliva, V., & Vigne, S. A. (2022). An introduction to the

special issue on Green Finance and sustainability. Journal of International Financial

Management & Accounting, 33, 379–382; A. Buller, (2022), The value of a whale;

Paine, L.S., Fetter, H., (2020), US Private Equity Firms: ESG and Impact, HBS

This course is a logical follow-up on the course (B23) 'Introduction to Finance and Banking' (the week before this course).

Also, many students combine this course with 'Sustainable Investing' (the week after this course).

Another logical combination is B26 'Business Innovation with Blockchain'.

What previous students (summer 2023) say about this course

"Amazing. Never thought learning finance could be this interesting, fun and enjoyable"

"I enthusiastically recommend this course to all future students seeking a transformative learning experience. From the outset, it captivated my curiosity and fueled my passion for the subject matter. The engaging curriculum, expert instructors, and collaborative atmosphere fostered a profound understanding of the material. Undoubtedly, enrolling in this course will be a decision you won't regret, as it equips you with invaluable skills and knowledge that extend far beyond the classroom."

Frans Boumans, MSc MBA

This course is open to students of advanced bachelor and master level. A background in Business Studies is not required. Instead, students are expected to have an interest and/or background in either finance or banking and have to be curious to explore new financial models and innovations.

If you have no or limited background in finance or banking, we advise you to first take part in the five-day course ‘Introduction to Finance and Banking’ and then take this course as a follow-on.

In all cases, a good command of English is necessary.

The learning objectives of the course are:

The student can explain the (changing) role of finance due to increasing focus on sustainability by companies:

The student can appraise relations between sustainable risks and funding.

The student can identify the steps necessary for financial practices for a better future for next generations

Students will prepare a project proposal that identifies a hypothetical project for a real company which meets the goals of the company (including ESG goals), facilitates the company’s strategic mission, includes the impact on the financial results, the project evaluation and a discussion identifying project risks and ways to mitigate or manage these risks.

Fifty hours of lectures/field excursions including assignments (self-study).

The course fee presented applies to all students currently enrolled in a bachelor, master or PhD programme and to 'Fresh Alumni'.

If this applies to you and you therefore believe that you are eligible for this fee, please include this in your motivation when applying for this course.

If not, the professional fee of €875 is applicable, and will be invoiced and visible for you in your account once you are accepted to the course.

Please note: if you do not provide proof that you are currently enrolled in a bachelor, master or PhD programme or a 'Fresh Alumni', we will charge the ‘professional (higher) fee!

The housing costs do not include a Utrecht Summer School sleeping bag. This is a separate product on the invoice. If you wish to bring your own bedding, please deselect or remove the sleeping bag from your order. In that case, do not forget to bring your own bed linen and pillow! In all cases, do bring your own towels, please.